Afterunintentionally producing an AI chiplet for Huaweivia a proxy, TSMC is set to stop supplying sophisticated AI processors for all of its Chinese clients from Monday, November 11, reportsFinancial Times, citingIjiwei.com, which in turn cited emails sent by the foundry to its customers. This change concerns advanced process technologies (such as 7nm and below) and will have a significant impact on China-based developers of AI processors. This does not, however, mean that TSMC will cease to serve these customers completely.

The new restriction is limited to AI processors and AI GPUs made on 7nm-class and lower nodes. Smartphone processors, chips for automotive applications, and other devices that cannot be used for military or dual-use applications are not affected, theIjiweireport stated. Sources with knowledge of the matter reportedly toldIjiweithat future supplies of advanced AI processors to China-based entities would require some kind of approval process, which likely involves specialists from the U.S. Department of Commerce.

It is unclear what TSMC plans to do with wafers containing advanced processors already in production, as well as with already processed wafers sitting in its stock. Perhaps, they will be shipped to actual customers if they get appropriate export licenses.

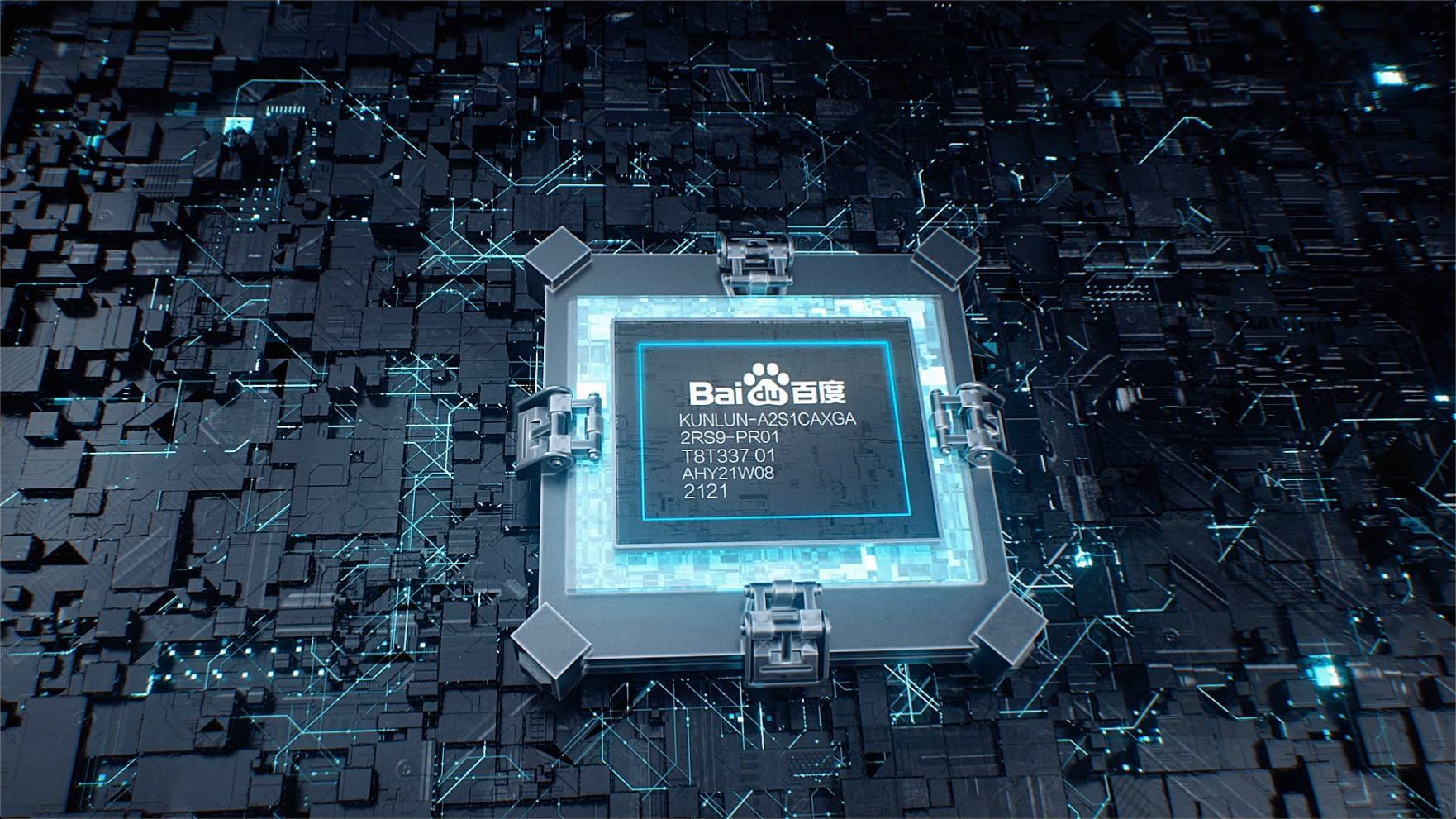

TSMC currently makes AI processors for chip giants like Alibaba and Baidu (which are mentioned specifically in theFTreport) that produce their custom processors (such as Kunlun and Kunlun II) at TSMC. TSMC also fabs hardware for several AI processor designers, such as Horizon Robotics and Black Sesame International Holding, that design processors for applications like self-driving cars, according toFinancial Times. For all of these companies, the new restriction will likely be a major setback, as they are highly dependent on processors made by TSMC.

The U.S. has already banned American firms, including AMD, Intel, and Nvidia,from selling their most advanced AI and HPC processorsto Chinese entities and has also created extensive export controls aimed at stopping other developers and manufacturers using U.S. technology from developing and producing such processors for Chinese companies.

Nonetheless, chip developers (including China-based andU.S.-based Nvidia) have either tweaked the designs of their processors to meet U.S. export rule requirements or obtained an export license from the U.S. Department of Commerce.SMIC succeeded in legally importing advanced wafer-fabbing toolsfrom American companies to its ‘legacy’ production facilities, only then using them at advanced fabs to make sophisticated chips for Huawei. As for Huawei, itusedproxiesto order chips from TSMC.

In fact, the foundry’s decision follows a probe by the U.S. Commerce Department into how sophisticated chips produced by TSMC for a Chinese customer ended up in a Huawei AI device, despite Huawei being under multiple U.S. sanctions. TSMC’s new restrictions reflect both a desire to strengthen its own internal controls and to prepare for expected U.S. export limitations on chip sales to China before President Biden’s term ends.

Get Tom’s Hardware’s best news and in-depth reviews, straight to your inbox.

Sources familiar with TSMC’s plans told theFinancial Timesthat the new restrictions are unlikely to significantly affect the company’s revenue. In an official statement, TSMC did not outright confirm that it had sent the aforementioned email to its Chinese clients, but it emphasized its commitment to being a ‘law-abiding company,’ dedicated to adhering to all relevant rules and regulations, including export control requirements.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.