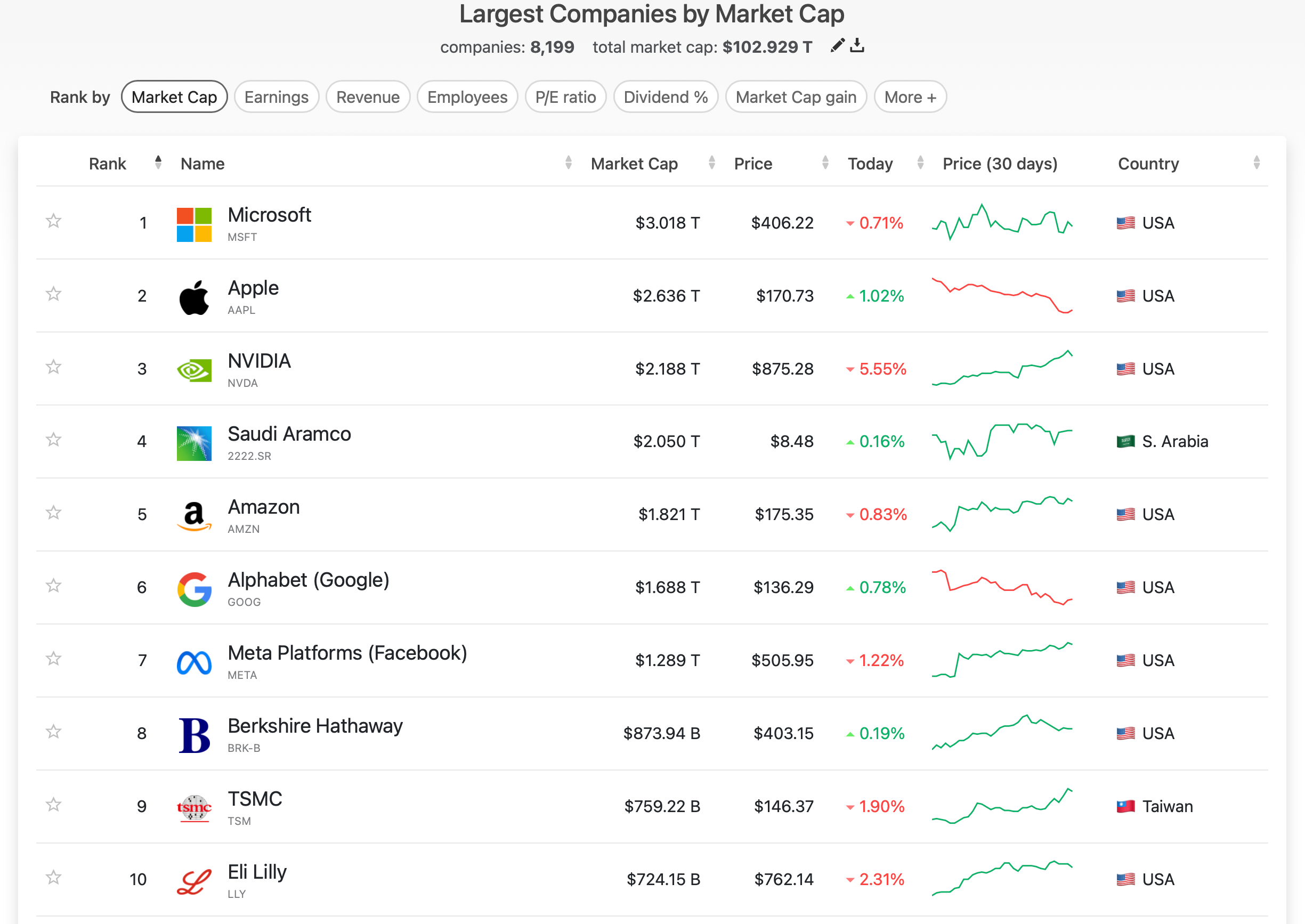

Having overtaken Saudi Aramco, Nvidia is now the world’s third-largest company in market capitalization, as observed byReuters. Nvidia’s stock continued its rally in recent weeks, and now the company’s market cap is on the brink of overtaking Apple’s, whose stock has been on a downward trend since late February.

What is perhaps more important is that the world’s three biggest companies by market capitalization are now high-tech companies. Software and cloud computing behemoth Microsoft is leading the pack with a market cap of $3.018 trillion, followed by consumer electronics giant Apple with a value of $2.636 trillion. In contrast, AI and GPU leader Nvidia is at No.3 with a capitalization of $2.188 trillion, according toCompaniesMarketCap. Seven companies in the Top 10 companies by market cap are high-tech companies.

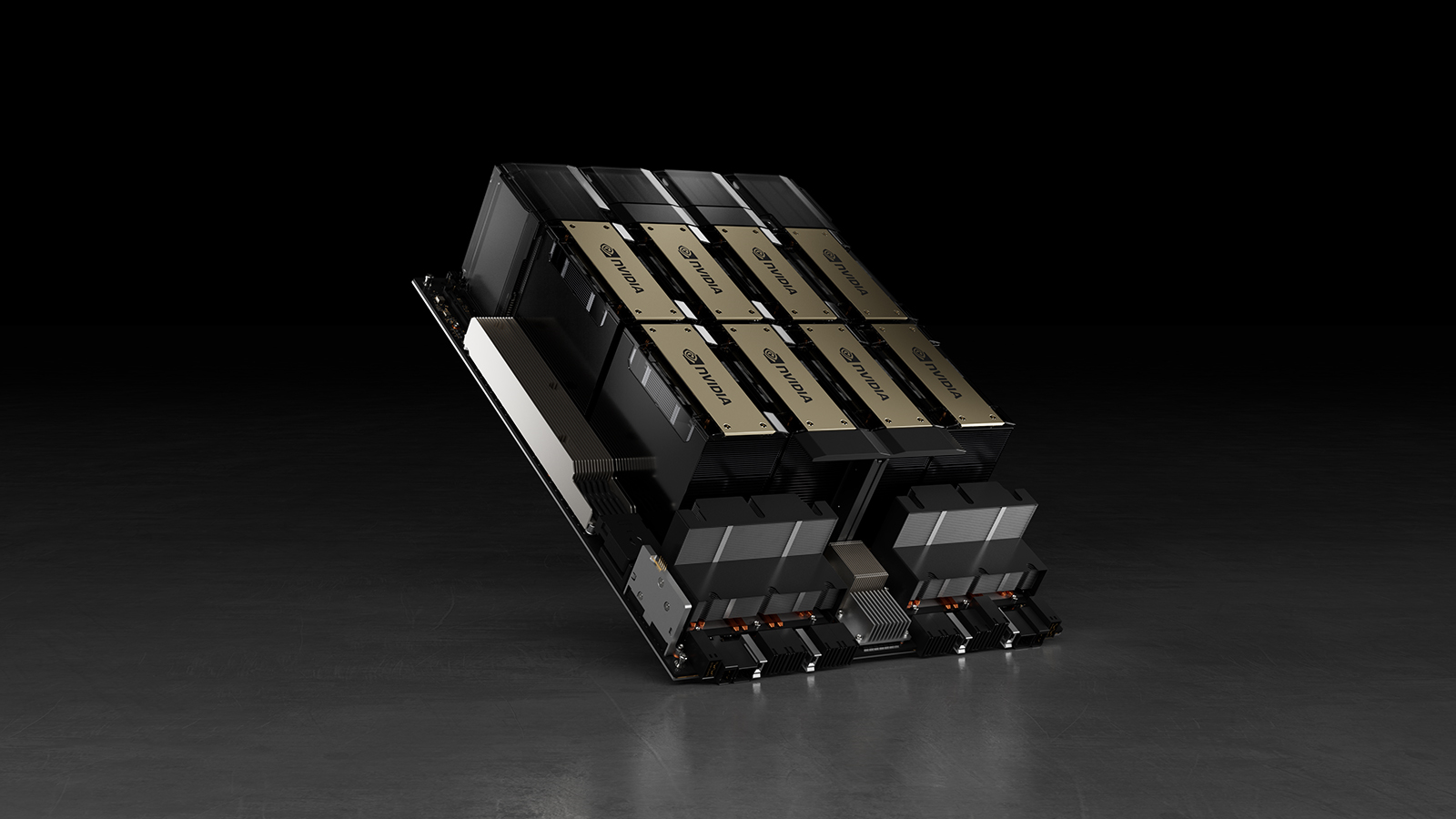

It is noteworthy that Microsoft and Nvidia have benefited hugely from the rise of artificial intelligence and the popularity of Open AI’sChatGPT. Microsoft’s Azure cloud service hostsOpen AI’sprojects (including the highly popular ChatGPT), whereas Nvidia hardware runs them. Hundreds more AI companies run on Nvidia’sAmpereandHopperGPUs, which is why the green company commands about 80% of theAI processorsmarket.

Meanwhile, Microsoft and Nvidia are not the only companies that benefited from AI’s rise. According to Reuters, Meta Platforms also demonstrated strong gains of 46.6% this year.

By contrast, Apple has faced challenges with slowing iPhone sales, losing its position as the world’s most valuable company to Microsoft. On the other hand, the news agency notes that Nvidia has replaced Tesla as Wall Street’s most-traded stock by value, highlighting its increasing significance on the market.

While sales of Nvidia’s GPUs for AI and HPC applications will only increase in the coming quarters, the company’s revenue will continue to rise; not everything was rosy with the company’s stock price on Friday. According toBloomberg, Nvidia’s stock experienced a significant 5.6% drop in its stock value, the largest in nine months. The stock had gained more than 19% in six consecutive trading days, leading to a surge in the company’s market value. But then traders decided to take their profits and sell the stock off, leading to a 5.6% decline in value.

Get Tom’s Hardware’s best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.