Nvidia CEO Jensen Huang’s current net worth is listed at $109.2 billion, putting him a significant valuation step ahead of Intel, whose stock price took a beating when itsfinancial troubleswere made public in August. The news has gotten to the point that various social media users have been sharing posts about it. See a popular example, below, with the caption encouraging the leather-jacket-loving executive to buy Team Blue.

Do it Jensen! I know you’re thinking about itIt’d be hilarious. We all support you pic.twitter.com/PIyyC1wDAbOctober 5, 2024

The AI frenzy and Nvidia’s performance as the leading AI GPU accelerator manufacturer has supercharged its stock performance, making itthe world’s most valuable companyby market cap last June. Although its share price has since corrected, dropping by around 10% from its record high, it’s still third in line with the five largest companies, next to other tech giants like Apple,Microsoft, Alphabet (Google), andAmazon.

This jump in stock performance has done wonders for Huang, who directly holds over 75 million Nvidia shares, plus 786 million more through various trusts and a partnership. Even though he hascashed in more than $700 millionby selling 6 million shares this year, this is just a drop in the bucket versus the estimated total value of his Nvidia holdings, at over $100 billion. This combination has allowed the Nvidia CEO to jump ahead in Forbes’ real-time billionaires list, putting him in the 11th spot, less than $20 billion shy of breaking the top 10.

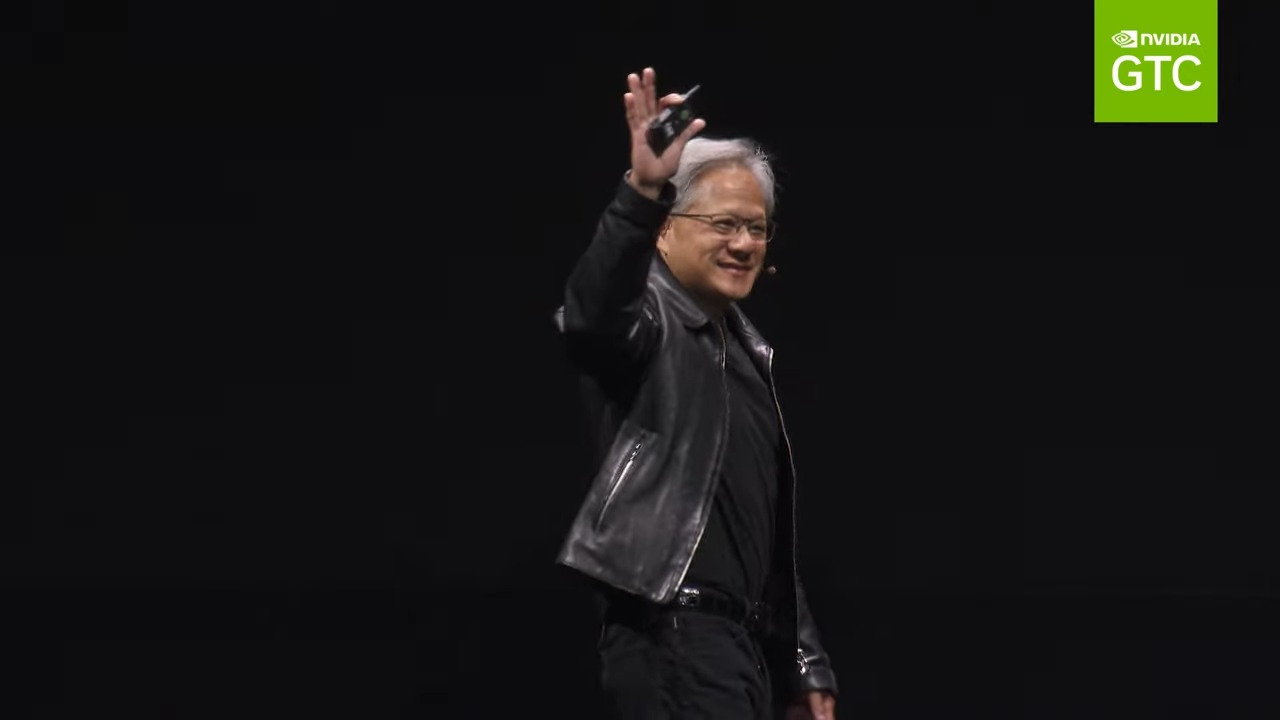

One interesting story, though, is that both Elon Musk and Larry Ellison, currently sitting at number one and two on Forbes’ list of richest billionaires, were known to havebegged Jensen Huangfor more AI GPUs, with the latter confirming the story during Oracle’s latest earnings calls. This adds to the Nvidia CEO’s star appeal, with severalA-listers seen attendinghis keynote at GTC 2024.

On the other hand, Intel, which hasn’t been having a good year, is currently valued at $96.39 billion. Its stock price at the time of writing is $22.59 per share, which is less than half of its record high from late 2023, of over $50. The company’s value plummeted in early August whenits financial strugglesmade a huge splash in the tech and finance worlds. This news caused the company toshed $39 billionin market capitalization practically overnight, with rumors saying that it could bekicked out of the Dow Jones Industrial Averagebecause of this.

While it may be amusing to see that Jensen Huang could buy up Intel and have around $13B in change, it is a highly unlikely move, and no one is expecting an offer to be made. There are also multiple huge regulatory and trust hurdles facing such a deal with the embattled chip maker. However, if Jensen Huang even showed an interest in an Intel purchase, as he did with Arm, it could be a story so big that Musk’s surprise Twitter purchase would seem like a tiny sand grain on the dunes of time.

Get Tom’s Hardware’s best news and in-depth reviews, straight to your inbox.

Jowi Morales is a tech enthusiast with years of experience working in the industry. He’s been writing with several tech publications since 2021, where he’s been interested in tech hardware and consumer electronics.