Intel plans to lay off more than 15% of its workforce by the end of the year, the company announced today, meaning roughly 15,000 employees or more (potentially up to 17,475 based on recent Intel headcount numbers of 116,500) — a vast restructuring that comes amid troubling financial results this quarter. The layoffs rank among the most severe in Intel’s 56-year history.

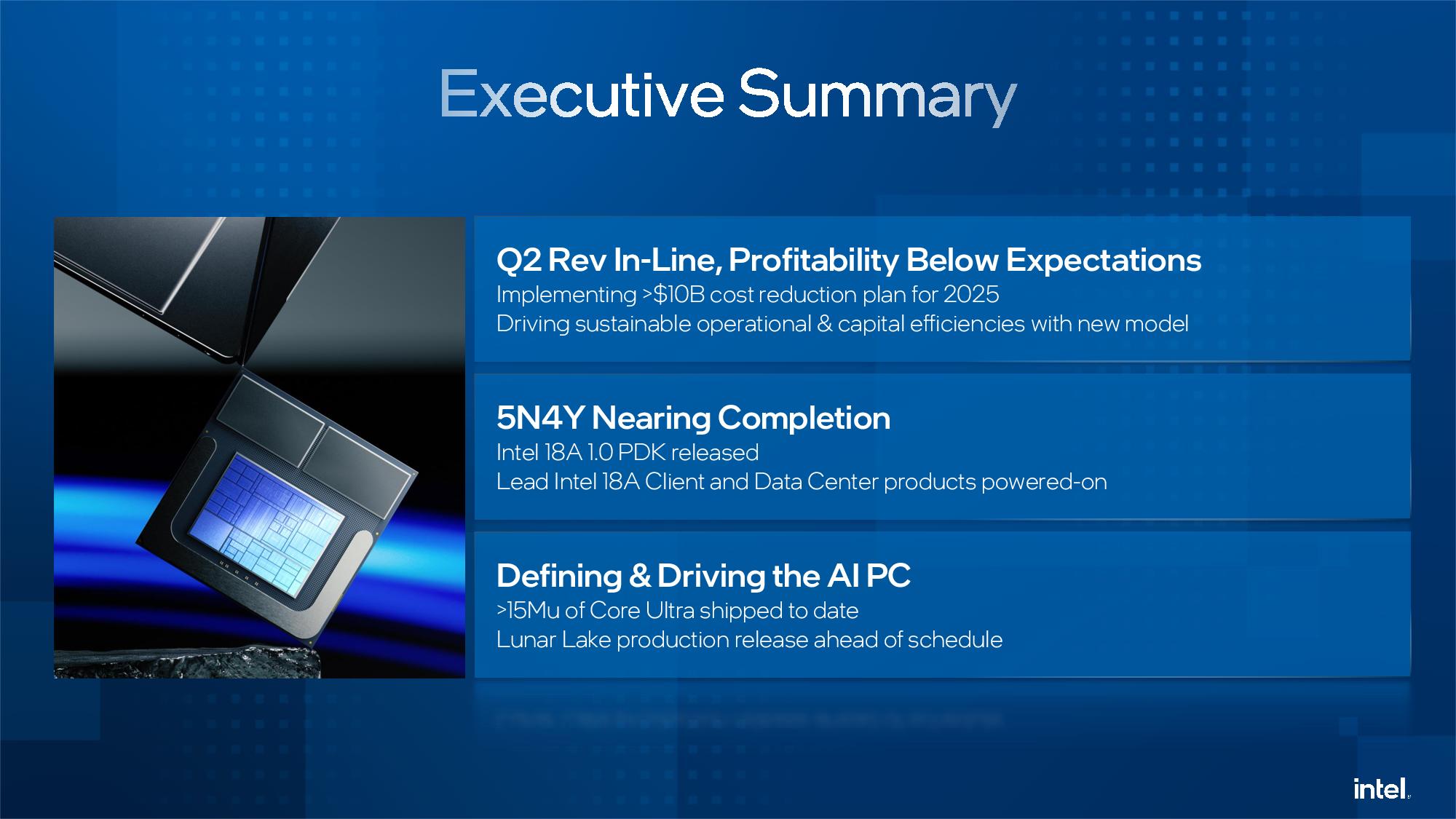

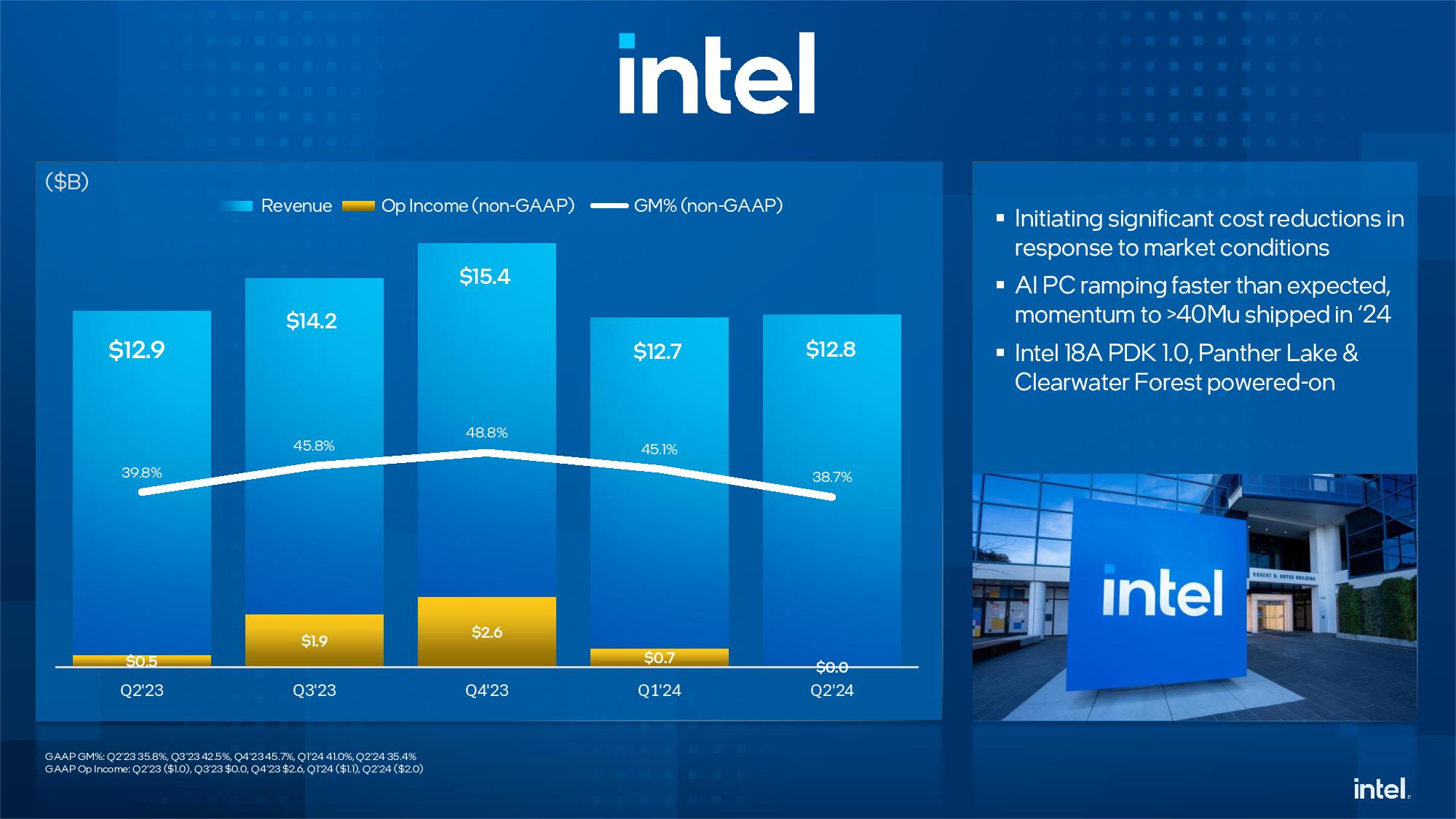

The news came during an earnings call for the semiconductor giant, which also announced that it has encountered yield issues with its Meteor Lake processors, problems that negatively impacted the bottom line. The company lost $1.6 billion in the quarter. Intel said it will cancel some ‘underperforming’ products in a bid to save costs and plans to suspend its seemingly sacred dividend in the fourth quarter. At the time of publication, Intel’s stock had dropped 19% in after-hours trading.

These decisions have challenged me to my core

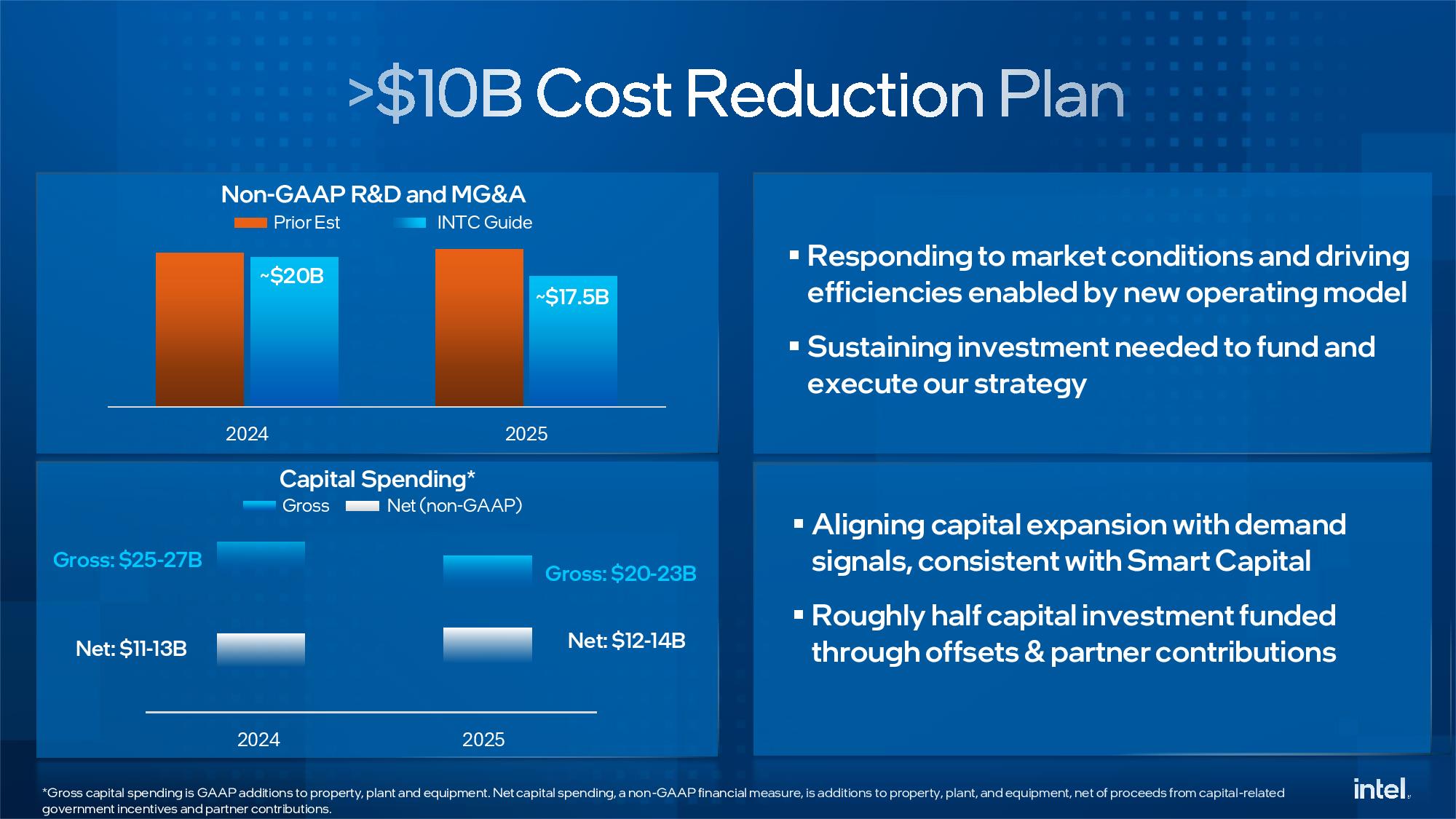

CEO Pat Gelsingeroutlined the changes and the rationale behind themin a blog post to Intel.com; he noted that the company aims to reduce spending by $10 billion in 2025 with the move. Intel will offer employees buyouts and early retirement options but will inevitably sever other employees via layoffs. Intel specifically called out looming cuts to marketing and R&D, the latter being a concerning development for a company that’s reliant on developing new tech, along with reductions in general and administrative staff.

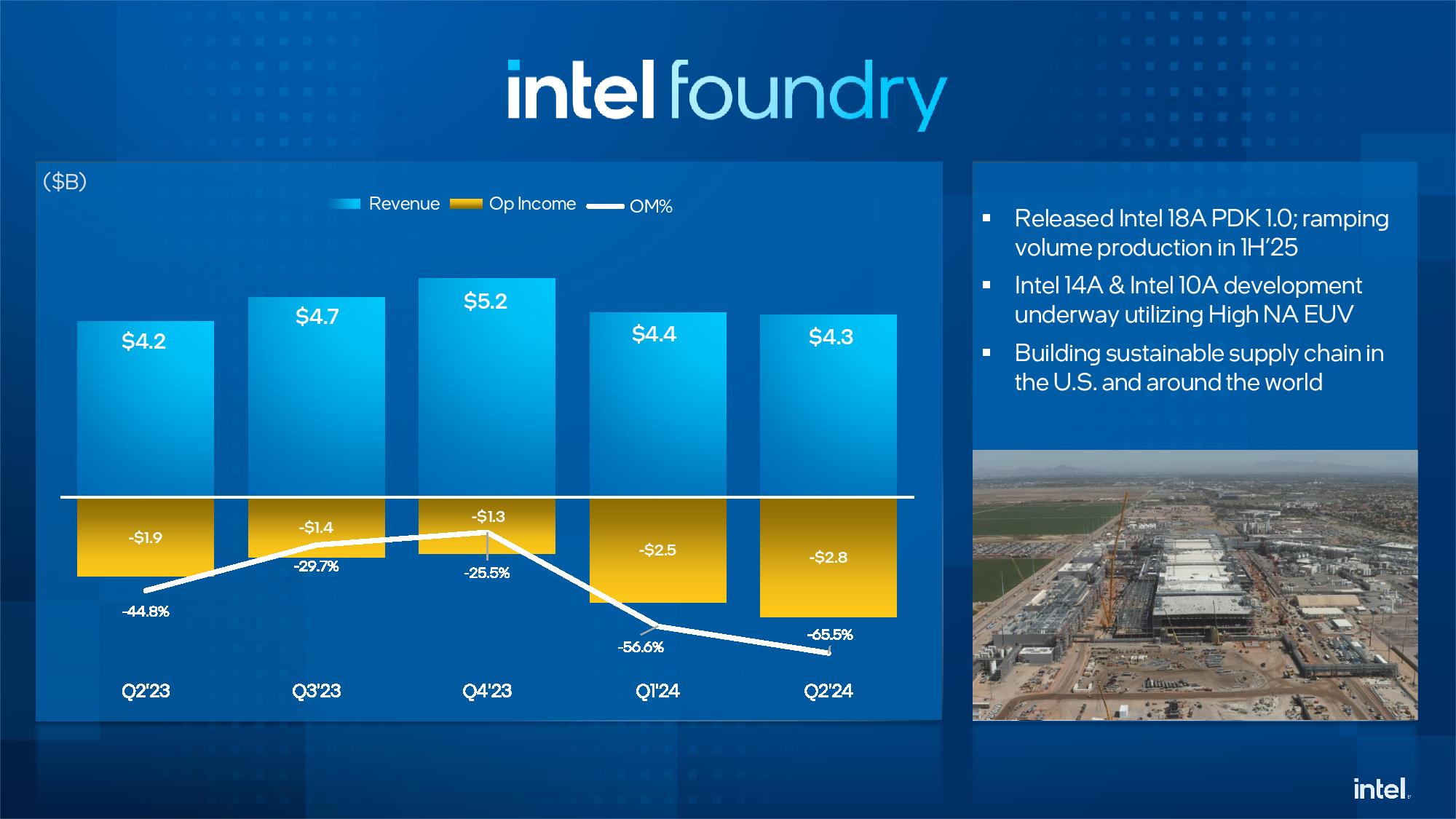

Intel did say that its 18A process node, which is exceedingly important to its success as a fledgling custom foundry, remains on track. The company recently released its 1.0 process design kit (PDK), a critical set of design rules that defines how its customers can produce chips using the node. Intel also says its next-genPanther Lakeand Clearwater Forest processors remain on track.

Analyst Patrick Moorhead Tweeted that Gelsinger told him about the Meteor Lake yield issue. It’s unclear if these issues are related to thewidespread crashing and instability problemsIntel has encountered with its 13th- and 14th-gen desktop processors. The company had previously cited a shortage of packaging capacity for its inability to meet OEM demand for the Meteor Lake processors, but Moorhead says Gelsinger told him that yield issues fueled the need for ‘hot lots,’ or accelerated wafer runs of chips that incur excessive cost relative to normally scheduled operations.

It was a very rough Q2 for $INTC. And that guide… Thanks, @Pgelsinger, for the time to discuss.It appears that there were yield/throughput issues on Meteor Lake, negatively impacting gross margins. When you have to get the product to your customers, and you have wafers to… pic.twitter.com/pHU66xvFe7August 1, 2024

Here are the most relevant bullet points from thecompany’s press release:

“These decisions have challenged me to my core, and this is the hardest thing I’ve done in my career. My pledge to you is that we will prioritize a culture of honesty, transparency and respect in the weeks and months to come,” Gelsinger said in his blog post.

Get Tom’s Hardware’s best news and in-depth reviews, straight to your inbox.

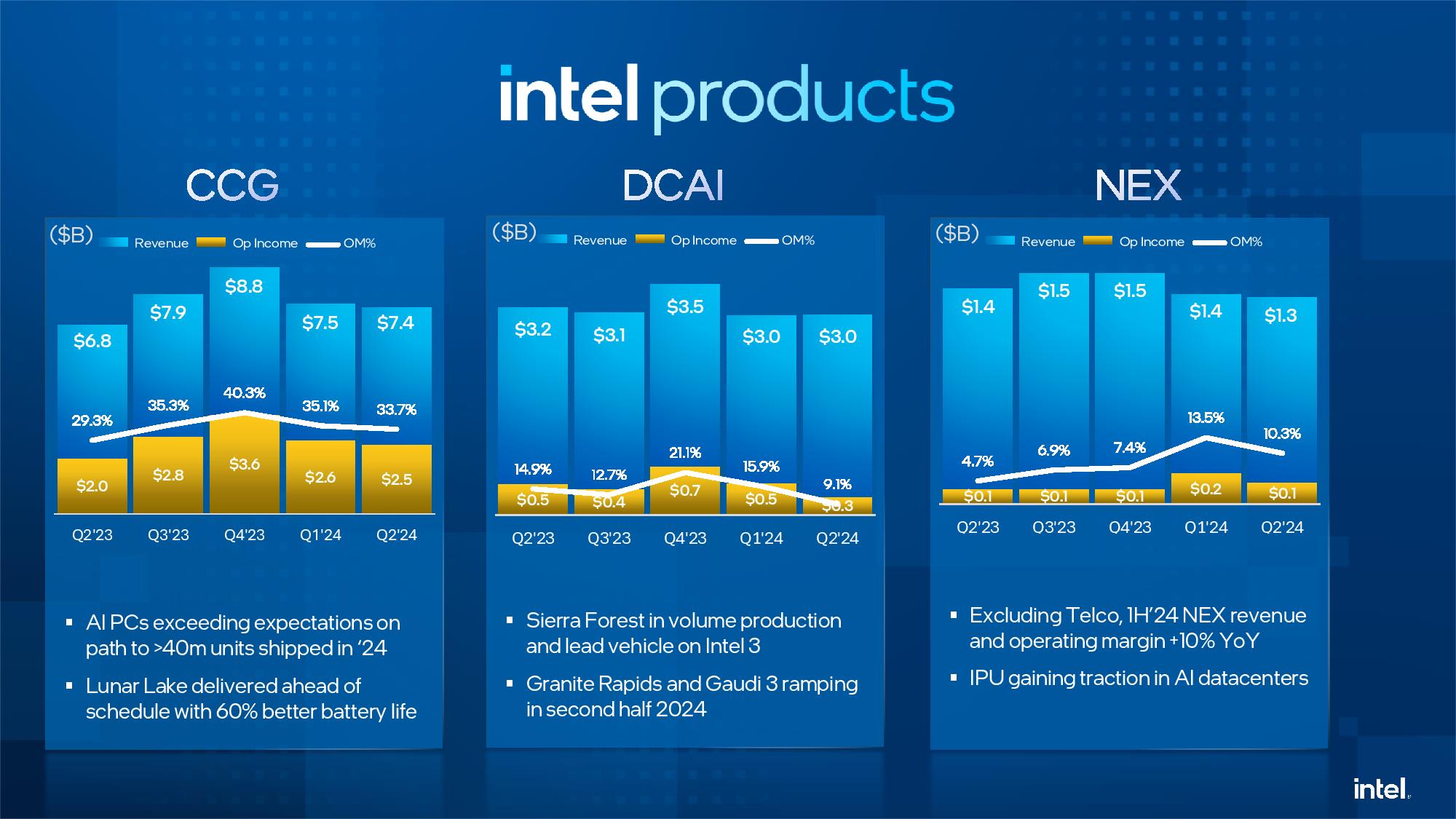

Intel missed its Q2 2024 projections as revenue declined 1% year-over-year, contributing to a $1.61 billion net loss. Intel posted a 38.7% gross margin, a notable 4.8 percentage points below guide. Intel also reported a much lower-than-expected guide for its third quarter of $12.5 to $13.5 billion and forecasts a disappointing 38% gross margin.

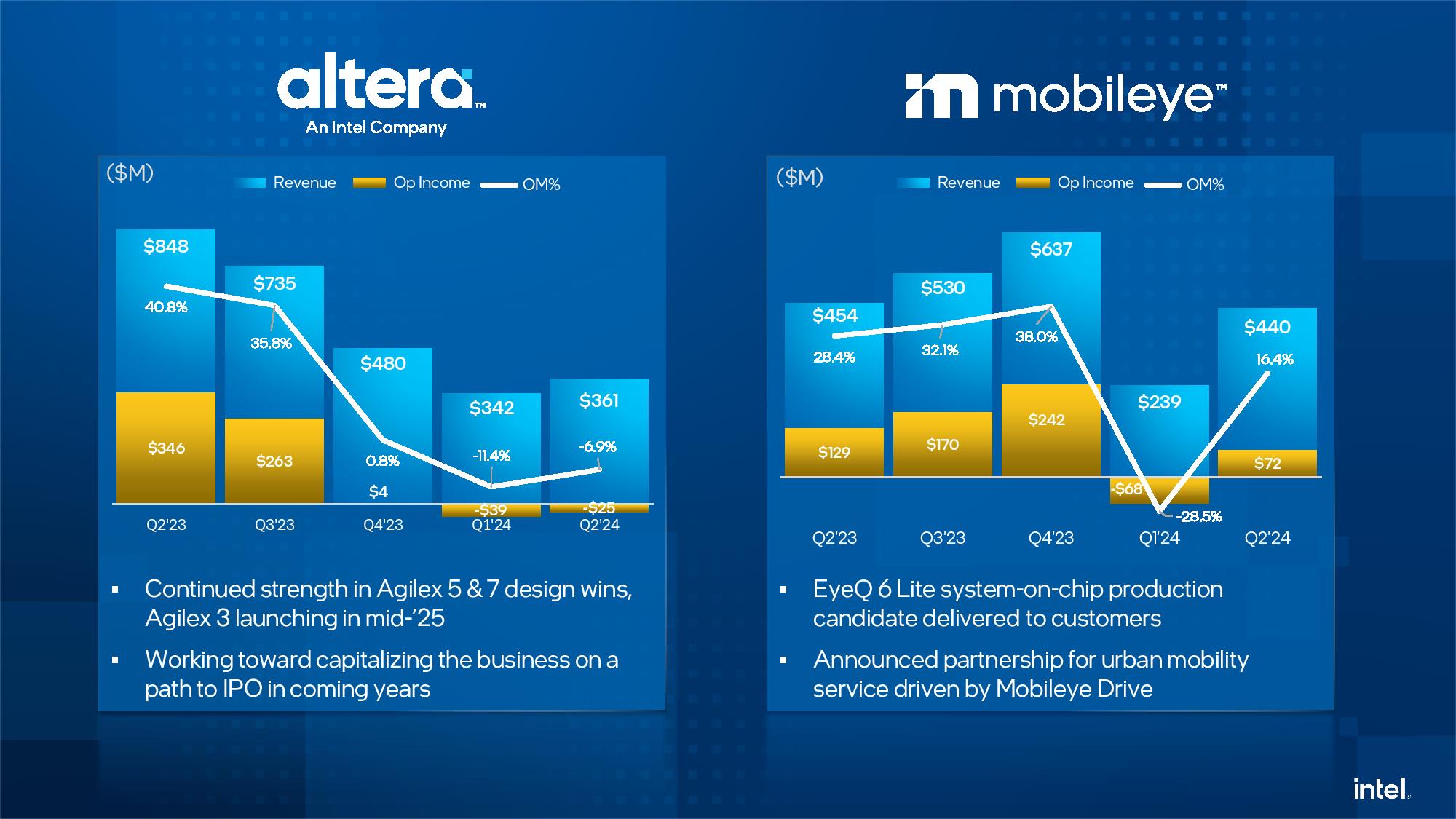

You can see Intel’s slide deck for its second-quarter 2024 results in the above album.

Paul Alcorn is the Editor-in-Chief for Tom’s Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.