About six months ago China launched the third instalment of its Big Fund. An investment to make the country’s semiconductor industry self-sufficient.The so-called Big Fund IIIis primarily meant tosupport developers and makers of chip production equipmentas Chinese chipmakers have lost access to advanced wafer fabrication tools from market leaders like ASML and Applied Materials. Now, it is time to spend the massive capital of ¥344 billion ($47 billion), reportsNikkei.

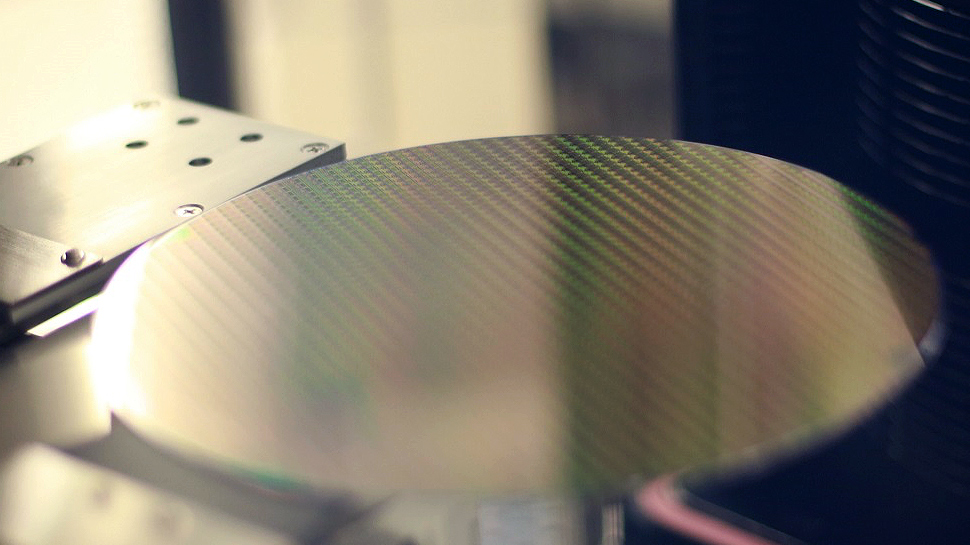

The third phase of the China Integrated Circuit Industry Investment Fund (or the Big Fund III) began operations on July 01, 2025. Just like the first two phases, it will be managed by Huaxin Investment Management, a firm founded in 2014 to oversee investments for all phases of the fund. Initially the fund will invest ¥93 billion ($12.685 billion) in various companies that produce materials likeultra-pure chemistry (e.g., resists) or silicon wafersas well as in companies that develop and build wafer fabrication equipment. For now, it is unclear whether the fund will focus on boosting established players like AMEC or Naura, or will attempt to help new start-ups to emerge.

$12.685 billion is a lot of money, but it is not enough to leapfrog market leading makers of fab tools. To put the number into context, ASML’s annual research and development budget totaled $4.308 billion in 2023, whereas Applied Materials R&D budget in 2024 reached $3.233 billion.

Since its launch in 2014, the Big Fund and its successor, Big Fund II, have collectively raised hundreds of billions of dollars, with investments of approximately $100 billion during the first phase (2014–2018) and $41 billion in the second (2019–2023). According to Bloomberg’s estimates in mid-2024, the assets then managed by the fund were valued at around $45 billion as they were affected by U.S. sanctions targeting China’s semiconductor sector. To date, the sanctions disrupted the most successful Chinese semiconductor companies, such as Huawei’s chip design arm HiSilicon, contract chipmaker Semiconductor Manufacturing International Corporation (SMIC), and 3D NAND leader Yangtze Memory Technologies Co. (YMTC).

Get Tom’s Hardware’s best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.