In a bid not to miss out on China’s growing AI and HPC market, AMD has quietly developed its Instinct MI309 processor, a lower-performance processor specifically tailored to meet U.S. export rules that require a license to sell powerful processors to Chinese entities. But apparently, AMD’s new product is still too powerful to get an unconditional green light from the U.S. Department of Commerce, and AMD still needs an export license, reportsBloomberg.

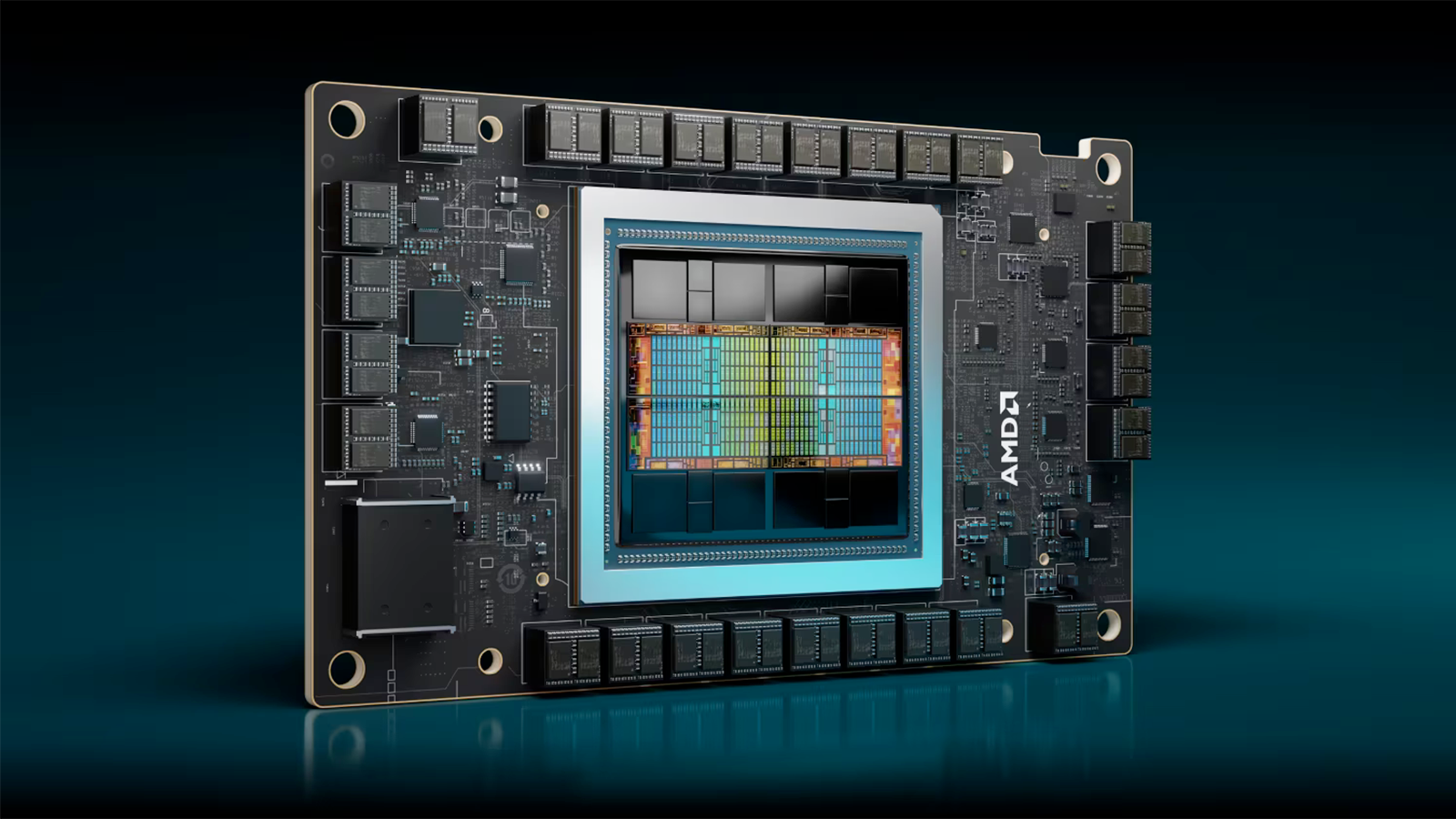

In general, AMD is pursuing the AI processor market, but it is pursuing the Chinese market even more aggressively with the launch of itsInstinct MI300-series, aiming to compete with Nvidia’s processors. The China-specific product, the Instinct MI309, is part of this strategy. The chip’s specifications remain unclear.

TheU.S. export rulesimposed last fall strictly prohibit selling Chinese entities datacenter processors with a Total Processing Performance (TPP, listed processing power multiplied by the length of operation) score of 4800, which means that the maximum AI performance of the processor should not exceed 600 FP8 TFLOPS. It is possible to sell processors with performance slightly lower than 600 FP8 TFLOPS, provided that their performance density (PD, which is TPP divided by the die area measured in square millimeters) is low enough.

AMD’sInstinct MI300Ahas FP8 performance of 1.96 FP8 PFLOPS, so AMD cannot sell it to China-based entities. AMD slowed the chip down — either by lowering clocks, deactivating some stream processors, or removing chiplets from the package — to comply with the U.S. latest export rules. But apparently, it was not enough to meet U.S. export limitations.

As a result, the fate of AMD’s Instinct MI309 product remains uncertain: It is unclear if the company will seek the necessary license for sale and, if so, how it plans to limit the performance of its processor for customers in the People’s Republic.

It should be noted that pursuing the Chinese AI market will not be an easy ride for AMD as China’s Big Tech companies have stockpiled enough Nvidia processors and may not be inclined to buy AMD’s offerings right now. Furthermore, China-based companies like Huawei are developing their own Ascend 900-series processors for AI applications. Given that those products are not subject to U.S. export control, many Chinese entities will prefer them over AMD’s products.

Get Tom’s Hardware’s best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.